SPY chopped and churned today and I post this 30 min chart just to show that all dips are quickly being bought, market looked set to close higher today but last half hour or so algos really started going wild and market got fairly volatile and we closed close to unch down fractionally.

ARUN broke out nicely today, but traders are already active in picking a top in the name as March 21 puts traded 6000 times. Worth noting and watching if shares start acting heavy or into earnings.

SODA got pounded today and I really have never heard or seen of anyone owning one of these machines. Traders were active today in far out of the money puts with 3000 March 42.50 puts at $1... geez 15% out of the money and still a dollar. Worth noting possibly for an equity short, but I am not interested in paying that premium for a short 15% out of the money.

EWZ saw a lot of put selling today, meaning people are short puts... bullish bets. Overall a positive sign. I am not in the game of selling premium yet but just of note as a positive tone to the markets. Brazil is probably one of the cheaper latin america plays currently, but seems to be some concerns over growth slowing etc...

TTWO is interesting here a name I have looked at in the past but never played but today traders were stepping in fairly large buying 9000 March 14 calls. Earnings are 2-5 I am interested in this play will look tomorrow for more follow through trading in the options market and look for an entry.

TWX has been on a strong run here RSI rolled over recently after putting in what appears to be at least a short term top. Today saw some odd positions taken with 8000 July 55 calls bought. Not really known as a big mover here but that is a fairly large position kind of far out for me but if there is additional accumulation could be something I get interested in.

HRB shares have been on a solid run and today a massive 25-20 bull risk reversal traded over 20,000 times. That is a serious position and one worth taking note of. I am not a fan of the company and while it shouldn't matter in trading its just not something I am interested in taking part of.

BBBY in a dead downtrend but shares looking to recover after putting in what appears to be a bottom. Today saw over 10,000 march 62.50 calls bought & what looks like a Jan 2014 57.50/77.50 call spread bought 3500 times. I am interested in the shorter term play here would like to see a break of the 60ish level for a run up to say hello to the 200 day.

Today's Action...

I posted a bunch of stuff at lunch time, but didnt include the things needed to get on stocktwits $$ or whatever still new at this stuff. Also will try to post more on Twitter when I enter positions.

BIDU will look to create a new play on this tomorrow. Like I showed in the lunch time post never chase these things in the morning when it ripped out of the gate these calls were trading at $1. I see people on Twitter chasing these all the time let it settle down pull back in and then look for an entrance. Look we saved ourselves 40% by staying patient and if it keeps running oh well we missed it. Better than getting caught up in opening bell euphoria when you see stock ripping a lot of calls hitting the tape. Only to see it retrace and your calls be worth .60 so not using a stop?

AAPL ripped today and I entered in today I failed to sell something against this position, but will look for some follow through tomorrow to make something happen.

MRK i bought the dip but it kept dipping will exit this position if 42.60ish fails.

NVDA I highlighted over the weekend and not going to discuss it much more. There was additional bullish flow today and a lot of these semis are looking good like ONNN MCHP etc.. There was 4500 weekly 12.50 puts bought today as well though a bit concerning.

OLN I saw some bullish positioning into earnings today and i decided to enter... The stock went crazy late day on a .50 run and I sold half my position booking about $700 in profits dont see if they reported yet, but overall in a good spot here. 345 consecutive quarters of payign a dividend... impressive! Is that even possible? Well thats what I see.

GOOG same thing as BIDU dont chase these things I saw people buying 765 calls at like 2.6 in the morning euphoria, we waited and were patient found a floor in GOOG or what appeared to be one and entered into $5 lower strikes for .55 less... Will do something with this position tomorrow as it is fairly large.

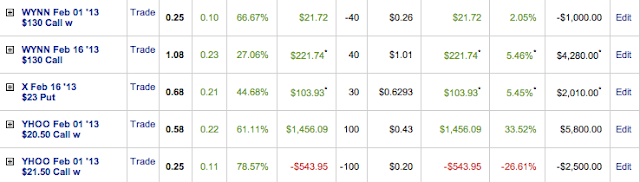

WYNN is consolidating nicely and saw some action in the 130 and 135 monthly calls so I like the play and decided to generate some front month premium. If all goes well and WYNN closes out the week 128-130 area I will then look to sell the monthly 135 calls and have a low cost basis if not free trade. Will keep you updated. Still a play that can be made.

As one of my readers pointed out to me TGT has been seeing a lot of bearish flow and it happened again today too, so much like X I could use a bit of short exposure here and on a weaker name so it makes sense. I may not hold into same store sales well see how the position performs. Also WMT has seen some bearish positioning.

X small speculative earnings play had some bearish flow and company is bleeding money each quarter so I am looking for a disaster. Getting a bit long too and could use some short side exposure.

YHOO one of the few positions I was able to remember to tweet. I wound up legging into the spread for .23 it never gave me that run into earnings I was looking for but still 5ish to one here risking 2300 to make 10K and I see it bid to 21.30 right now... So maybe I finally hit an earnings play would be nice.

There was some other interesting stuff, but this track pad/mouse is bothering me right now... Will note some of the stuff for tomorrows post. TQQQ saw some bullish positioning expecting tech to move higher near term something worth noting.

Last, I been seeing some questions on certain position but the one that stood out to me the person already covered their short so I wont discuss it, but I am willing to look at 1 or 2 positions a week and give some thoughts on how you could make it more effective with options. If interested post a comment or something and I will pick a few and highlight them.

May do some earnings strategies later.

Take Care

Such effective and useful graph today and see great results on your market.Options Trading

ReplyDelete