While big banks are getting all of the attention these days, and well deserved as they have been on tremendous runs and they certainly are looking higher technically and following the options flow, which is extremely bullish. I do think some such as GS & MS are a bit extended and can use a rest to consolidate some of their recent gains before continuing. While others such as C & BAC are riding their 20 days and currently have fallen below their 10 days also need some time to develop and regain their strength before taking out 52 week highs and carrying on their rallies.

So while running scans I came across many regional banks, which many appeared to be already consolidating their gains and looking to make runs and new 52 week highs imminently.

KRE regional banking ETF is sitting at its 52 week high just as XLF is making new 52 week highs. On KRE last pull back it dipped below the median line in RSI working off its over bought with a more severe pull back, while XLF touched the line and bounced and is now nearing overbought territory of 70 RSI & KRE still shows room to run. Both look very bullish.

KRE Longer-Term View

XLF Long-Term View

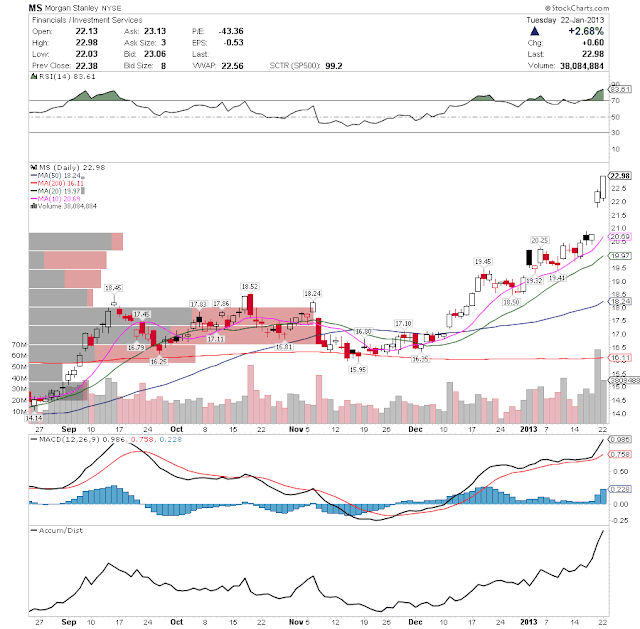

When you begin looking at individual names within the sector it becomes clear that many of the names have worked off the overbought RSI and are romping up for higher prices based on that indicator. They have bullish MACD crosses recently occurring and many of them have tremendously bullish ACCUM/DIST indicators as well. For the most part many are over their important moving average with a few wrestling a bit with some at the moment. Below I highlighted a dozen names that are beginning to break out or about to break out.

Individual names: JPM saw massive buying in the Feb 50 calls 40K vs 2K OI. More than 7 to 1 call buying in the Feb strikes on Friday. Very bullish. April 50 calls also has size in OI to the tune of 12K. This one is heading above 50 in my honest opinion. Position accordingly.

MS on Friday saw an Interesting position taken traders bought 30K Apr. 24 calls & sold 30K jan 2014 30 calls for basically even a small outlay of a nickel. Such a pretty trade, and what does it tell you LONG banks until April and then get out.

There is no clear trend of big money flowing into these names, and also the leveraged ETF KRU does not trade options so there is little information there, but overall the regional names in my opinion could be the next big movers.

In my opinion there is a trade here, and maybe there's a dozen... or more.

No comments:

Post a Comment