FB shares broke down after last weeks announcement or lack there of MACD crossing over bearish and RSI is rolling over, but traders are stepping in expecting a run into earnings and positioned for a run into and after earnings. Traders bought about 40,000 Feb 1/8 34 call spreads. So traders sold the Feb1 34 calls and bought the Feb 8 34 calls for about .14. I really like this play and I too picked some up on Friday for .16 (with a .01 spread more times than not you have to pay the ask for both legs so mine was .02 higher than other traders). This trade is still available and i really like this one as being a low risk high reward play.

DISH looks great here and closed on the highs on friday MACD bullish RSI bullish with room for higher prices Accum/Dist very bullish. Options flow is extremely bullish in this name with call to put ratio in OI sitting at about 4.5/1 through March. I like this name through the 38 break. I like the March 37 calls where nearly 7,000 sit in open interest. Of course the equity is always an option as well.

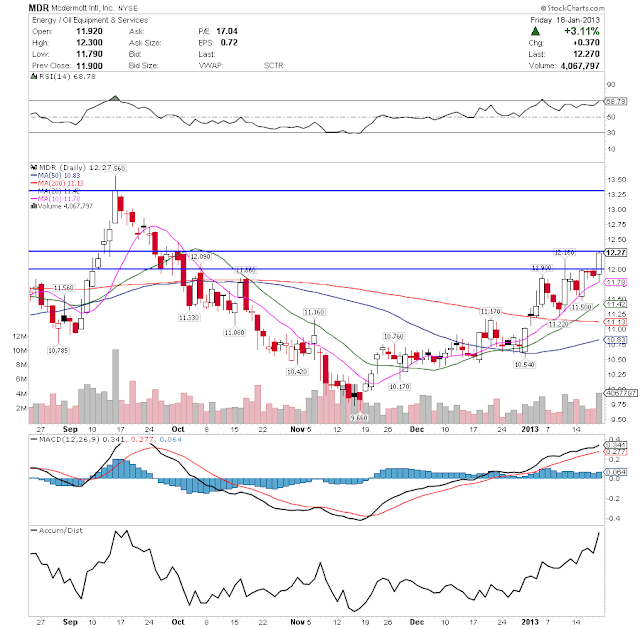

MDR a name that broke out on Friday, but still looks great on multiple time frames it stalled as you can see on Friday multiple times around 12.30 so that is the break we need for what should be a run to the 13.50 area. Options traders targeted this name on Friday with the Feb 12 strike finding buyer of 8400 calls against OI of 1300. So a trade is there in the Feb 12's but these traders were paying .35-.45 and they are now trading .60-.70 so I would not play the options here, but rather the equity. Options saw a big spike in IV and entering them here is like chasing a $1 candle, it is just not something advisable or in general not something profitable, but i do like the equity play here.

OPEN set up really nice on Friday, and broke out late wish it would have waited but still looks really good through Friday's highs.

XLF continues to look very strong and I would focus on the leaders within the sector such as GS although a bit extended at the moment, MS & JPM. But I was looking for a longer term play on the group because if you look at these individual names the bullishness in options is extending through April. April huh debt ceiling was supposed to be in March but low and behold there is an extension on the table to push it to April, these guys are smart. So I turned to the XLF as I have been playing these sectors with a lot of success as in my opinion their options are mispriced and are very cheap.

March 18 calls on XLF are .10

April 18 calls on XLF are .20

I will play the April 18 calls, it is a bit further out than I normally like to go, but it offer a great risk reward and I will probably look to exit before April for around $1. Trimming and trailing as I go... in a perfect world I guess.

Individual names JPM saw massive buying in the Feb 50 calls 40K vs 2K OI. More than 7 to 1 call buying in the Feb strikes on Friday. Very bullish. April 50 calls also has size in OI to the tune of 12K. This one is heading above 50 in my honest opinion. Position accordingly.

MS on Friday saw an Interesting position taken traders bought 30K Apr. 24 calls & sold 30K jan 2014 30 calls for basically even a small outlay of a nickel. Such a pretty trade, and what does it tell you LONG banks until April and then get out.

GS nothing unusual but the positioning is again bullish through April.

MU been a strong runner here as shown on ethe weekly and Friday saw calls heating up led by FEB 8 18k & next weeks 8 calls trading 14k times possibly looking for a sympathy move from SNDK report. A name to watch next week and if you want to speculate the 8 calls are a way to do so.

EXPE not the strongest of weeks but Feb call buyers were again active on Friday with 1400 Feb 65's going off around 2.30-2.45 and OI of 5800. Maybe seeing the 20 day as a good entry point, I do think can put out a feeler or starter in this area into these calls and add to them once it can reclaim the 10 day and stop out around the 61 area. It is an aggressive play and calls are not cheap so it will be important to book gains and leave some trailers if it gets moving.

VMW an ugly day Friday and RSI rolled over MACD turned bearish and options traders smell blood and moved in for Feb 87.50 puts, which look good through the 50 day. Or can take a starter here and add later.

Other notable names with options activity AIG, MWW, ODP, SHLD, DNKN, ITW & SINA.

Sorry for being brief on the last names, but they are worth a look, I have to cut this short as my wifi keeps dropping every 1 minute and is annoying me. I will put out a nice earnings piece later highlighting some of the key reports in the week ahead and some possible ways I will be looking to play them.

The stuff were very informative and helpful.I get good idea about Options Trading.

ReplyDelete