Markets began a bit soft but as has been the case as of late mid day dip buyer again were active and ripped the markets to highs to end the day. After hours got beats by IBM, GOOG, CREE & ISRG all should bode well for the market moving forward. Banks led the way down in the morning, but helped rip it into the close and FAS finished on the highs. On to our day.

IBM earnings play is looking like a loser now as they beat this quarter but looks like a cut for the year, but shares are up 5 points. Also missed the fill on selling the 185 puts well see if there is anything to salvage there tomorrow.

GOOG sounds like revs were a tad light, but EPS was a bit better and probably most importantly cost of mobile clicks was only -6% compared to the expected -8%. So since blogs inception we are 0-4 on earnings plays. Still hating them for now hahah. The GOOG play was risking $1 to make $20 so still offering great risk reward and well see if there is anything to salvage there tomorrow.

TLM is a name that is setting up well here and calls continue to be accumulated, there was a big seller in the name today, which kept it in check, but i think higher prices will come and I followed some of the larger trades today into the March 12 calls.

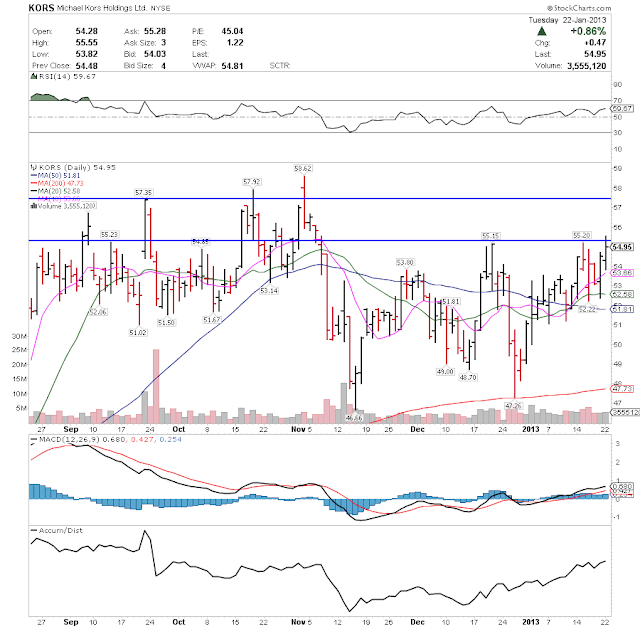

KORS broke out of the three month range briefly today but closed below, I do like this name for a trade through today's highs.

MPC a name that continues to consolidate and break out and looks ready for more. Today saw a very large position taken in what looks to be a bull risk reversal with 5000 July 75 calls bought and 5000 55 july puts sold. So the 75 calls are ones to look at on any dip or any consolidation before breaking out.

PSX in the same sector as MPC and after two days of a small pull back allowing the 10 & 20 days catch up will look to resume the rally through 55.80ish. Also a name seeing large bullish positions taken today with the March 60 calls trading 6400 & Feb 60's trading 4300 also of note a staggering 33,000 Feb 55 calls in OI. Certainly a name and sector to be mindful of and I may look to add the March 60 calls tomorrow.

TPX a name building a ncie bull flag and now riding the 10 day while shares work off over bought accum/dist is very strong and today traders stepped in and bought 3700 Feb 36 calls.

FB shares rebounded today and reclaimed the 10-day and this weeks 31 calls saw a lot of action today with 26K being traded and need to check OI tomorrow to ensure they were not all scalps. We are positioned in the name already with the Feb1/8 34 call spread.

APC another name breaking out today. Today we say Aug 80 calls traded 10,000 times in the $6 range but also of note is the massive bullish positioning in this name May has 47K 80 calls in OI March 75 calls 46K in OI & 24K 80 calls in OU Feb 75, 77.50, 80 calls showing 16K 10K 22K in OI respectively. Hard to argue with that type of positioning and a name to consider here.

VRX sitting in a nic bull flag and today traders were active in Feb 65 & 67.50 calls for 2200 & 1700 respectively. The 65-67.50 call spread at about .80 offers a decent risk reward trade.

FAS opened a little lower and ripped to close on the highs the theme is still there in the bank names BUY THE DIP.

"The GOOG play was risking $1 to make $20 so still offering great risk reward and well see if there is anything to salvage there tomorrow."

ReplyDeleteYou did a put credit spread on it right?

I dont see how you would get that can u explain it?

Sure it is a ratio put spread. I bought to open 25 670 puts for 8.48 and I sold to open (meaning I was short the puts) at 3.67*2, which is $7.34. So I had a net debit on the trade of $1.14. And I could profit $20 if GOOG closed at $650.

ReplyDeleteAnother way to view it is long a 670-650 put spread and short 650 puts.

So below 630 I become long GOOG 1 for 1 anything below 630.

Let me know if that helps or if you have further questions.

Great stuff Keith, fingers crossed on my IBM lotto calls.

ReplyDelete