Solid action all week Friday was a tad dull but they usually are a bit less uneventfull. For the week SPY booked a solid 2% gain, QQQ despite AAPL managed 1.47% & the DOW stopped lagging and began leading with an impressive 3.04% gain. Short-term view of SPY shows the battle zone is 169.43-169.56 area for the next leg higher and short-term support 168.74 & then 168.35. A few nice rest days before what appears barring any drastic headline events a move to 170 & then a test of highs 171 area.

XLV added 2%, XLF 2%, GLD -4.7%, SLV -6.75%, XLP +2.39%, XLE +1.29%, XLU +.62%, & XLY +2.66%

This is an example of a newsletter sent out daily if you'd like to be added e-mail: keeblerelf0602@gmail.com. Otherwise can check back here as I will post the occasionally through StockTwits/Twitter (@keeblerelf3).

Economic Data Schedule

Technical Set-Ups

AIG watching the $50 break.

AMD has shown strength with the rest of the semis watching the 3.90 area for a break.

AMP consolidating its last gap up very well and forming a tight little flag watching for a break out through 52 week highs.

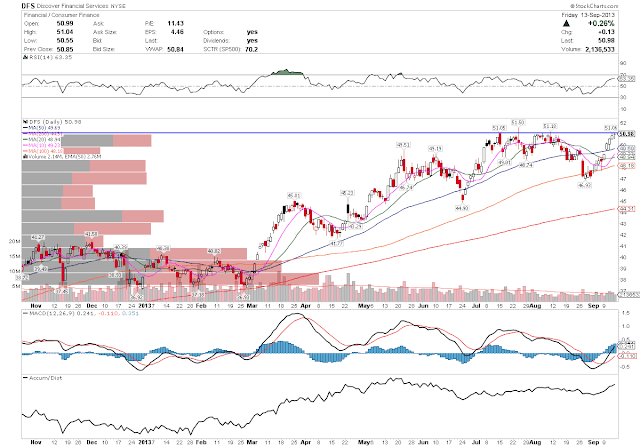

DFS interesting spot here and has gone on a big run since testing its 100 day moving average could use some consolidation here, but I am eyeing the 51-51.50 area for strength and volume.

On Friday DFS saw a Longer-Term bull spread trades trader buys Jan 2014 55/60 call spread and sells Jan 2014 44 puts for a nickle.

DLTR still love this set-up and am watching the 55-55.09 area for a break higher.

GILD 4 days of low volume chop, watching for volume to return for a run through 64.

ICE looks set for a resolution here looking for a move through supply and break through downtrend 182-182.50 area.

LUK looks great here as it holds its last gap very well and is currently flagging right under its 100 day. With its 10 day moving average running back through all moving averages as it catches up to price looking for a high volume break out through the 28 area.

MCHP a nice tight launching pad here, eyeing the 39.86-40 break.

BAC RSI is rolling over and this probably needs a bit of time but worth setting an alert for that 14.69 break. Also watching GS 165.80.

BC Straight forward 39.86-40 break.

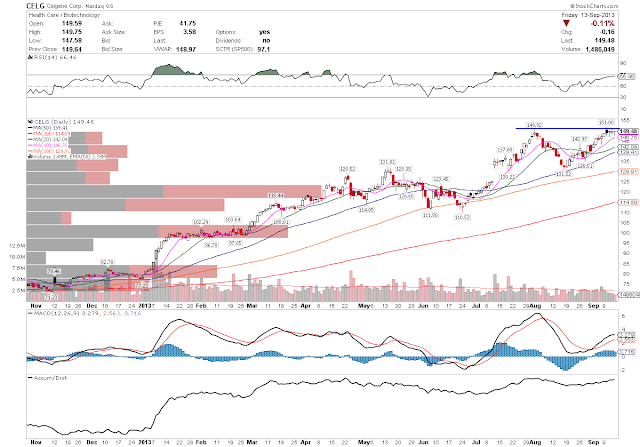

CELG had a failed break out last week but BIIB went on Friday and I am watching CELG for the next leg higher through 151.

HON 84.43-84.50 break on watch.

LVS momentum play through 64 for a day trade.

OWW nice bottom pattern here with a large gap above watching the 10.30-10.40 area for a break into the gap above which is about a 10% gap.

SLM been setting up for weeks, still watching the 25 break.

Looking for a swing long here through 112. RSI running MACD bullish cross, pattern target highs at about 120. Stop below 109.50 area.

Held small break out well after giving guidance watching 40.40 break.

WAG momentum play here 53.50 break for a day trade.

Still remains my favorite set up here in WHR looking for a swing long through the 137.66 area.

WMT gets interesting for a gap fill play through 75.

Beta Names

AAPL for the week was down a cool 33 points or 6.7% over reaction? or cause for concern? only time will tell. The 50 day is sitting at 463.55 & when you pull up the hourly you see AAPL really needs to hold onto that 464-464.90 area as it also coincides with a back test of the prior break out. One possible scenario would be a Monday morning heavy volume flush straight through all that support and tag the 200 at 457ish and bounce and reverse, I would test it long there. Another scenario is AAPL opens up and fades to red in which case I would be looking to short the 464.80ish break going red.

A few trades from Friday 1600 Sept 21st 480 calls for $2.00 a massive $320,000 position, currently down $96,000 ouch. Also 500 Sept 21 470 calls $212,000 position bought late in the day so luckily for them still roughly flat.

TSLA finished the week down ALMOST 1% wow, I am looking for that to change in the week ahead and am going to look for a swing opportunity if the price action is right I am interested in getting long on a dip to 161.68 area with a stop below 158.51 or through the 10 day 166.65 and the stop there would probably be the low of the previous 10 minute candle. Trader buys 5,000 Jan 2015 30 puts for a buck ;) GL! Also Sept 27 175 calls 200 for $3.05.

Options Activity

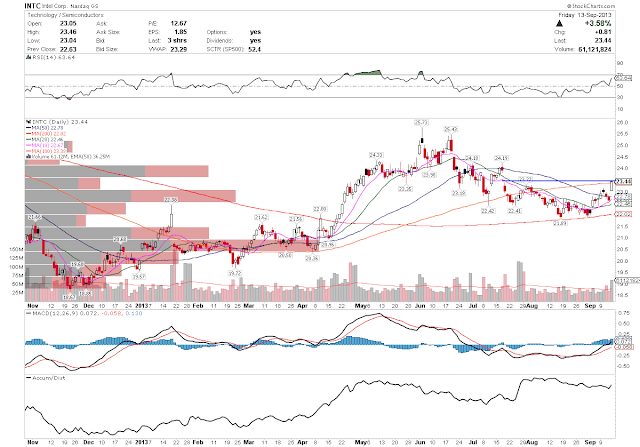

INTC with the upgrade on Friday was able to put in a strong day and ended the day strong, closing above all moving averages and the 10 day crossed the 20 day recently. Closed the day sitting right on the gap above, which has room to the $24 area. Traders do not see this move as sustainable and were actively purchasing Oct 22/20 put spreads for .18 over 50,000 of the spreads were bought.

My take: INTC tends to perform poorly on EPS as they continue to lack mobile chips and a slowing PC market continues to be their target market. I can see INTC continue an upward move with market strength and filling the gap above the trades are significant in size, but not something I would dive into. Noted for EPS.

Catalyst: Earnings release 10/15.

TEX has filled the June gap and now sits at resistance of prior short term trend support & the prior break down. Trader looks to fade recent strength and buys 2,500 September 33 puts.

My Take: Not actively looking for shorts, and not looking to short into strength.

Catalyst: 9/17 Citi Global Industrials Conference

CIE breaks out of the rounded bottom and into the large gap above roughly $3 of gap above. Trader sees value through year end and buys 3,000 Jan. 2014 30 calls.

My Take: Has a lot of work to do here and a lot of supply hurdles to over come. In addition it goes beyond my time frame. With that said continues bullish positioning into year end in many names "Santa Clause Rally".

Catalyst: Earnings 10/28

AMTD building a nice consolidation flag here from prior big break, some low volume selling with RSI flattening out, 10 day crossed 20 & 50 day bullish looking for volume to enter RSI to rev up and break to new 52 week highs. On top of last weeks noted bullish activity Friday saw traders active in October 29 calls for 2,300.

My Take: On watch for the 27.88-28 break for a move to $30. Oct. 29 calls are not a bad way to participate, but personally would play 28 calls.

Catalyst: No known catalyst, earnings are after Oct expiration on 10/28.

ADSK a very sloppy name but has show signs of strength as of late and Friday trader stepped in for 2,300 Oct 41 calls, while another trader entered an Oct 40/37 bull risk reversal 1,000 times.

My Take: Bullish play but I prefer other Tech names and not looking to get involved here with no catalysts. Noted the action with an alert for $40 for that volume bar break out for a trade only.

Catalyst: No Known.

ARMH big winner for use from last weeks newsletter as we bought the Monday break out and sold into the big stick on Tuesday. Trader looks to fade this rally and buys 7,200 Sept 45 puts also smaller size buyers active in the same puts and the Sept 46 puts. Puts ran 5X daily average all centered around those strikes with a -280K Net Delta.

My Take: Rally does seem over done, but again not necessarily seeking shorts, but 15 minute chart shows $46 as a key level so alert set for 46 break down noted the action.

Catalyst: None

HIMX is a volatile name and shares quickly rebounded from earnings and there was a lot of call buying into the report as well. Friday saw calls heating up again with Oct 10 calls with 2,000, Sept 9 calls over 3,000 Oct 9 calls 500 & Dec 10 calls over 1,000.

My Take: Well initial call buying was wrong into the earnings report, but look like geniuses now, there's a lot of action there running 3x daily average call buying and calls now 5x more in open interest than puts. It is an extended name and certainly not something I am looking to chase up here.

Upgraded on 9/11 Earnings 11/4

AVNR unfavorable patent settlement has shares tumbling, already down 33% from the peak traders see a lot more down side coming buyers of Dec 4 puts 4,000 block & 2 1,500 blocks in addition to 2,000 Mar 2014 4 puts and a seller of 2,000 March 5 calls (need to confirm opening or closing with OI Monday)

My Take: Small cap pharama is just not my thing and down 33% already with IV at 121 vs 70 HV60, I wouldn't trade it with someone elses' money, its just not for me.

MSFT a few days in a row now with activity in Sept 35 calls Friday saw buyers active for over 7,000 on top of 20,000 on 9/11 and now almost a quarter million sit in OI.

My Take: Low delta speculation plays are not my thing but an alert set for 33.22-33.40 area break as the chart does show some signs of strength, and may trade weekly 33.50 calls if the opportunity presents itself.

CIEN big move past two weeks and Thursday's dip was quickly bought right back up as this looks like it wants to make a run back to 2011 highs in the 28's. Friday a trade buys 3,200 Oct 25 calls.

Stiefel upgraded shares on 9/5 to $27 citing momentum in international tier 1 wins.

My Take: It is extended here and I am not going to chase it up 20% in less than 2 weeks.

No Known Catalyst.

APC rejected on this long-term upper trend line and has tended to have some severe sell offs the past three or four times its hit here, but trader wanted to be involved on Friday's small dip and puts on a large bull spread enters Nov. 97.50/110 call spread and sells 3,000 Nov 85 puts for a 1.25 debit.

My Take: Pretty large bull spread here, setting alerts for 97 area for break out & 92 area for a dip buy.

Catalyst: EPS 10/28

BPOP another nice move off the watch list last week, after noting the Put buying on Wednesday caught the big candle down on Thursday a nice rest day on Friday and this could be ready for another leg lower. We alerted the Oct 30 put buys and Friday the trader stays bearish but takes some profits and rolls out 2,250 Oct 30 puts to 2,250 Oct 26 puts.

My Take: Well already saw a big move and is now a bit over sold, but 29 area is major support so alert set for a break down from there for a short-term trade.

No Catalyst EPS 10/23 after expiration.

Other Options Activity

MU- Trader sells 13,500 April 2014 20 calls, sees long-term shares under $21. Trader buys Jan 2014 15/17 call spreads 5,000 for .94 not a fan of the play at all.

EPD- Trader buys 1,200 Oct. 60 calls.

GLD- Oct 135/122 Bear risk reversal 3,000.

MNST- Trader close 5K Sept 50 puts & buys 4300 Jan. 2014 45 puts.

HTZ- Another solid one from last weeks newsletter Friday found more call buying with Sept 27 calls 2,800 & 500 in addition to 800 Oct 27 calls. Would like to see some consolidation here, but alert set for 27.75 break.

HUN- Trader rolls out Sept 19 calls 1100 to 1100 Sept 20 calls.. Set an alert for 20 break with a note on the action.

AGU- Trader rolls 1,000 Oct 90 calls to 2,000 Oct 95 calls, another trader see a large move near term and shorts a 87.50/92.50/97.50 call fly for a 1.80 credit.

WAG- Another great break from last weeks newsletter Friday sees traders active in Oct 55 calls for 1500 & Oct 57.50 calls 1,000. Alert set for 53.50 for a day trade.

Trade of The Week

SE has held its 100 day moving average and has woken up a bit on Friday, as it looks to break out of this bottoming pattern and move higher. Traders have been active in Oct 34 calls & Dec. 35 calls for week and early in the year I saw similar action in the name when it was in the 20's. RSI is running and is looks to cross the median line and last week saw a bullish MACD cross & ACCUM/DIST begin to curl up.

The Trade: Long Oct. 34 calls on a break through Friday's highs at .50-.80 or better.

1st target 34.50 area 2nd target 35.50 3rd target 36 4th target 52 week highs.

Stop below 32.50.

Earnings

Of note I in general only enter Earnings trades the day of event because I want to continue to monitor the options flow, I will update any significant trades in the newsletters leading to the event and its impact on my view. In addition as price changes into the event the trade changes. For example FDX is trading 107 now & trade is 106-104-102 put fly if FDX is 109 into report the trade would change to 108-106-104 put fly etc...

DRI reports 1st quarter earnings on 9/20 before the market opens with high estimate of .81 average estimate of .71 & low .62 on revenue of $2.2 billion. DRI has missed EPS estimates in 2 of its last 3 reports. On 9/6 Wunderlich initiated a hold with $50 price target. Shares of DRI are coming out of a summer long downtrend and are banging into 50 day supply. Friday saw traders active in Sept 47 calls over 1,500 & Sept 49 calls over 600. The options market is pricing in a $2.10 move roughly a 4.3% move. Slightly expensive in comparison to prior quarters.

Resistance will be found 50.21-51-52.24-52.50-53.60-54.66 with support 48-47.76 47.40-47.25 46, 44, 43.

Trade to consider: Long Sept 21 49-50 1 by 2 ratio call spread & Long Sept 21 47-46 ratio call spread.

For a net credit of .10.

Profitability range- 44.90-51.10

TIBX reports third quarters earnings 9/19 after the close with the street looking for .22 a share on $258 MM in revenue compared to actual earnings of .27 on $255MM in revenue last year. TIBX has missed EPS view the past 2 quarters. The options market is currently pricing in a $1.80 move by Sept expiration, which is historically roughly in line. IV is elevated into the upper 60's with back month October in the upper 40's. Friday saw a trader buy 6,500 Nov 20 puts with 10,000 already in open interest, while another trader opened 1,000 Sept 25 calls.

Trade to consider: Unfavorable trends in this group and the recent run up in share price I like the low risk play of the Nov. 20 puts for .30 or better.

ORCL reports Q1 earnings 9/18 after the close with the street looking for EPS of .56 on revenues of $8.5 billion. ORCL has missed on EPS the past two quarters and 3 of the last 4. The options market is currently pricing in a $1.66 move by Sept. expiration. Shares have gaped down sharply after the past two reports, but in each instance have recovered well. Thus far traders are liquidating positions & there aren't any clear trends yet in the options market.

Trade to Consider: Short Sept 21 34/31 strangle for .55 credit and Long Oct 19 34/30 strangle for .74 debit. Total trade cost .19

FDX is set to report earnings 9/18 before the market opens and the street is looking for EPS of $1.51 on revenues of $11 billion. FDX has missed EPS expectation 2 of the past 3 quarters. Options market is pricing in a $4.60 move by Sept expiration roughly in line with historical expectations. Significant open interest remains in 110 calls from the rumors that sparked a massive rally in shares, but shares fizzled last week and sit right above the 50 day moving average as traders brace for earnings. No substantial positioning in the past few days.

Trade to Consider: Long Sept. 21 106-104-102 put fly for .20 debit.

ADBE reports earnings 9/17 after the market close and the street is looking for EPS of .34 on revenues of $1 billion. ADBE has had a strong year and has pleased investors by beating EPS expectations for the prior three quarters. Options market is pricing in a $2.30 move by Sept. expiration in line with historical pricing. ADBE shares have closed higher for four straight reports.

Trade to Consider: Long Sept/Oct 50 call calendar spread for .32 debit.

A more aggressive trader might also buy Sept 47 puts & short Oct 47 puts for .40 credit. Giving .08 credit for entire trade.

This is an example of a newsletter sent out daily if you'd like to be added e-mail: keeblerelf0602@gmail.com. Otherwise can check back here as I will post the occasionally through StockTwits/Twitter (@keeblerelf3).

This is for informational purposes only and should not be viewed in anyway as investment advice.

No comments:

Post a Comment