This is the week of 9/23-9/27 and some of the more interesting options trades, the way I saw them as well as some of my notes along the way. Wednesday is not included as I had a computer issue and lost most of my data. Enjoy!

Monday 9/23

HAS- Trader wants more time and rolls out of 13,000 Oct 50 calls to 13,000 Nov 50 calls, as shares put in a topping candle with follow through selling.

Earnings 10/21/13 so trader also is now position to participate.

My Take: Not much here right now, but noting the action for earnings.

NVDA coming under a bit of selling pressure with the market and failed to hold the 10 day, trader gets a tad bearish and gets long 20,000 Nov. 15/14 put spreads for .25.

My Take: Earnings are 11/11 & it a low risk trade with a lot of negative divergences looking to take place MACD bear cross RSI rolling over & accum/dis fading. I am noting the action also setting an alert for the 15.32 area, although I think it is probably more of a buy zone then a short area.

SWY holding its gap very well, and continues to exhibit relative strength in comparision to the markets, today saw a sweep of 3,500 Oct. 32 calls. Net Delta on the day +370K.

My Take: Signifigant short-term positioning and a trade I am interested in as it suits my time frame and in addition to a technical set-up & a catalyst with Earnings on 10/10. Setting an alert for 31.80 break, and will look to piggy back the same trade.

GT has been an incredibly strong stock all year, and has certainly become a buy the dip name after a blow off top shares have faded to test the 10 day, which has held for now. Today a trader comes in and buys 3,000 Jan 27 calls for .55 seeing signifigant upside into year end.

My Take: Strong performer and this trader sees a lot of upside, I am setting an alert for the 20 day $21 area for a possible IRA add.

EMC shares are falling hard here after another FED induced blow off top and closed just below the 50 day. A trader sweeps 2,200 Oct 23 puts.

My Take: This is a very low delta play & earnings are after expiration, the area it tested today the 26.12-26 area is going to be interesting to see if it can hold there could certainly be a short trade here on weakness through that area, but certainly a -.04 delta is not a play I am interested in, but its possible on that 26 break for a higher delta play such as weekly 26 puts.

AMRN shares down about 20% off the highs and traders get very active near the lows in Oct 9 calls over 10,000 7 ran 3X daily call volume with a Net Delta of +276k.

My Take: Not my area here in the smaller Pharma names, but open interest here is getting bullish. Overall I have no interest IV30 is also running 150 compared to HV30 of 50 so I assume there is a PUDFA date or something related to a new drug.

JCP really a disaster here and a company that probably goes bankrupt before consistantly earning a profit as shares continue to make new lows and currently testing 2002 lows, yes you read that right 2002.

Traders active in Nov 13 puts for 5,100, Oct 11 puts 1,200 Oct. 12 puts 2,000. Net Delta -654K today.

My Take: I am setting an alert for a 12.12 break down, but will take a shorter term trade, if the action looks right.

ACHN building a sloppy flag here and today saw traders active in Oct 9 calls for about 4,000, also selling Oct 9 puts about 1,300.

My Take: Again not really my area but there is a technical break of 7.50, which targets the summer highs of about 8.50. A lot of stars would have to align for me to trade the 7.50 break and I would only trade shares. IV30 is 100 compared to HV30 of 32 so assuming a drug date looming.

AIG shares gap below 10 day and close near lows trader buys 4,000 Oct. 52.50 calls near the end of the day.

My Take: There will be plenty of opportunity to be involved here in a better spot rather than being the first kid in the pool. I have an alert set for 50 & 51 probably won't get involved until 51 break though.

UAL shares bounced off 10 day Oct. 38 calls finding buyers over 5,000.

My Take: We have DAL on the list, which sets up better in my opinion.

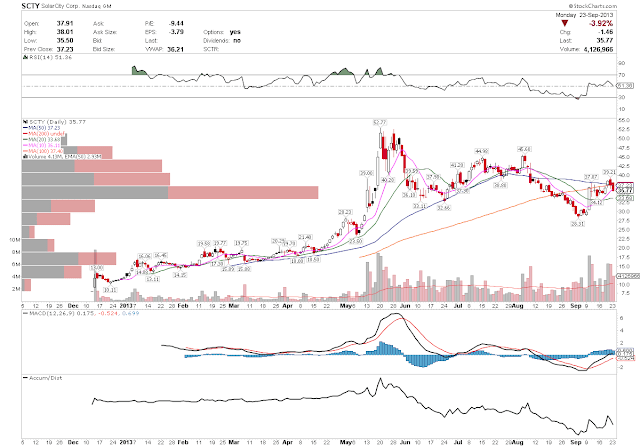

SCTY shares now off almost 10% from highs in 2 days and today saw traders getting bearish 2,100 Oct 40 puts a $1MM position also this week 36 puts finding buyers.

My Take: Hard name to be short for a longer period of time as it tends to have wild up days, but the weekly 36 puts are interesting through today's lows and then that 34-33.68 area break could really accelerate this down. Setting an alert.

MS traders nail the short right at the open getting long over 4,000 Sept 27 puts at .21 & taking profits on about 1,000 at .34 but still seeing more downside on the balance.

My Take: Shares could really accelerate down as you have the a close below the 20 day and the 50 day at 27.12, with Jun resistance also at 27.12. Setting an alert on weakness of 27.12 breakdown will be looking at weekly 27 puts if the scenario arises.

IRM interesting here as it looks to have bottomed traders get very bullish today with 7,000 Nov 30 calls, 3,000 Oct 32.50 calls Net Delta +195K. Ran 12x daily call volume.

My Take: Certainly notable action with a large gap above, setting an alert for 28.85.

CWH- Oct. 22.50 calls 3,500, Jan 14 22.50 calls 3,500 & Nov 25 calls 2,000. 10x daily call volume average as it attempts to hold its 100 day. It is a REIT and not something I am interested in trading.

C- -530K net delta with traders targeting Oct 45 puts for 3,000 & Oct 49 puts 1,000, banks have been heavy and have trend support here at 49 so setting an alert there noting the action.

MU- Oct. 16 calls with size buyers over 5,000 also trader rolls out 5,000 Oct. 17 calls to 5,000 Oct 20 calls. MU is always a friend of mine and I have alerts set for 17.60 break.

STX- Trader buys 4,600 Oct. 40 puts making almost entire avg daily volume in itself so a pretty big trade here as shares remain heavy. Alert set for 40 breakdown.

JPM- Trader takes a shot and buys 4,100 Oct 04 55 calls at end of the day. I am not a big low delta shot taker and shares need a lot of work here before considering any longs.

SINA- Trader opens a large bull spread near lows of day today buying 1,000 Dec 90/105 call spreads & sells 1,000 Dec 65 puts for .20 debit.

XOMA- Trader buys 2,500 Oct 5 calls, needs a lot of work could explode through convergence of supply though through 4.67 area.

UPS- 1,900 Oct. 92.50 calls, setting an alert for 92 break.

GE-2,500 Oct 25 calls bought, also 1,500 Oct 24 puts.

TSO- Put in a hammer today and closed near highs trader buys 1,200 Nov 48 calls looking for upside.

EZCH- Trader tries to bottom tick it here buys 1,000 Oct. 25 calls.

CAT- Trader buy 750 Jan 2014 87.50/80 strangles.

PCLN- Sweep of 100 Oct. 1015 calls at 14.20.

VLO- 600 Oct 34 puts, nice short in MPC today from list still eyeing the 34 break down here.

Tuesday 9/24

WFC shares are treading water, like most of the banks as it sets up for a test of 100 day support. Traders stepped in today with almost 30,000 Oct 45 calls, also 1,000 Oct 11 44 calls.

My Take: Watching banks for shorts tomorrow on weakness and while sizeable call buys here they are low delta plays and not really my thing especially with recent weakness in banks. Possible catalyst is earnings on 10/11 but WFC not really a name to move 10% on earnings. Will take note of the action for earnings.

After breaking to new highs shares have sold off about 5% and sliced through the 10 day like it wasn't even there has a small gap below at 45 and 20 day support at 44.85. Trader buys 13,000 50/42.50 Feb 2014 bull risk reversal for .20 debit.

My Take: Longer-term than I prefer but a massive position on a solid growth name and a lot of support in its current area. Possibly a name to study a bit more for a longer term hold.

CTL currently sitting in a big bear flag and shares are being sold into strength trader buys 11,000 Nov 30 puts for .40.

My Take earnings on 11/4 as a potential catalyst and I do like the technical break down here. Setting an alert for 31.73 break down here for a move to the low 30's would eye the Nov 31 puts and evaluate as it goes.

Airlines perking up a bit and JBLU is attempting to set up 7 break has a volumepocket which should lift this pretty quickly to 52 week highs. Trader buys 5,000 Oct 7 calls and over 7,500 in total today running 10X daily call average.

My Take: Interesting play and a cheap one, but misses earnings. I am setting an alert for $7 break and noting the call action & will monitor in the days ahead. On 9/12 Dec 6 calls saw some activity about 500 & 9/5 Calendar call spread traded 1,000 times Dec 7/Mar 7 for a .22 debit.

YHOO shares broke out to new highs today and ran 4x daily avg call volume with the bulk of it coming in the form of Jan 2014 38 calls seeing buyers of 20,000.

My Take; These are 20% out of the money with 4 months to go seems awfully expensive in the .70 range earnings are 10/15 & probably missed Q4 earnings in January. Anything is possible even a takeover, Alibaba money etc... But this is a stretch I am a long-term holder in YHOO and should continue to be a buy the dip name, but I am not interested in this trade.

END shares have rallied 150% off of March lows and are currently consolidating their last break today saw traders get very bullish buying Nov 7.50 calls over 7,000 and running 9X daily call volume.

My Take: This play does get earnings but it is a company that has missed estimates 6 straight quarters and 9 out of 10 not exactly a stunning track record. Prior month saw a lot of Sept 5 call buying, which wound up working out well for those traders. Not sure here right now setting an alert for 5.93 right now and am intrigued by the action and willcontinue to monitor and see if any additional interesting trades occur.

IRM another day with signifigant sizing 3,000 Oct 32.50 calls 2,500 Nov 30 calls & an Oct 40/45 1 by 2 ratio call spread for .02 debit.

My Take signifigant sizing for two days in a row looking to get involved possibly in Nov 30 calls here tomorrow for some gap filling. EPS 10/28

CTB shares 12% off highs here and selling is picking up, a trader puts on an interesting spread today selling an Oct 30 straddle for 2.75 credit & buys Nov 28 puts for 1.85.

My Take: Such a cool play here as trader looks for bearish action but expects shares to consolidate this move down a bit before breaking down again & be positioned for earnings on 10/28.

AA- Trader sells 30,000 AA Jan 10 calls, would assume closing action but have to confirm tomorrow with OI check.

LINE- Trader buys 5,300 Jan 2014 28/34 call spreads & another trade 1,800 Oct 28/30 call spreads.

INTC- Some size buyers in Oct 25 calls, but a lot of traders exiting positions as well and ultimately net Delta of -700K today.

YOKU- trader buys the dip with 1,800 Dec. 30/35 call spreads for 1.15.

EBAY- Trader buys 3,000 Nov 55 calls & 1,000 Oct 60 calls bought.

ALK- Longer-Term play trader buys a Jan 2014 65/75 1 by 2 ratio call spread for 1.80 debit. Very interesting play in another airline that has been on a run. Barrons ran a bullish piece on shares not too long ago as well

GE-Trader opens 2,500 Oct 24.50 straddles.

TLM- Buyers of 15,000 Oct 10 puts.

PM- Ratio put spread 87.50/82.50 1k by 2k for .92 debit.

QLIK- putting up a bearish engulfing on weekly but trader sees rebound and buys 1,500 Oct 40 calls.

WY- Over 4k April 31 calls bought.. I do not trade REITS and its too long term.

VOD- Noted all the Nov 34 & 35 call buys in chat did not think it was going to break out today though, but it did and closed on highs.

AXLL- Jan 45/40 strangle buyer 2k

Thursday 9/26

UPS setting up really well here still working off oversold conditions and a bit more sideways action would be constructive 20,000 Jan 2015 110/120 call spreads bought today for .70 debit.

My Take: Well for me I am looking more short-term and I will be looking at the Oct 92.50 calls on a break above that 92.12 area. Also one might consider the November 92.50 calls, which would also include earnings.

HTZ sold off hard today as they cut earnings forecast as it seems as if they are discounting a lot as rev miss was a lot smaller than the income miss, but some see opportunity as the Dec 23/20 bull risk reversal trades 5,400 times & the Dec 23/21 bull risk reversal trades 4,400 times.

My Take: You know never want to be the first kid in the pool, but this sell-off could be over done, but for my money I need to see evidence of that before dipping my toes in.

CNP shares flagging here and could be worth a look above 24.30 area with that volume stick break out. Trader buys 10,000 Oct. 25 calls looking for a move back to highs.

Back on Aug. 23 trader also purchased 7,200 Nov. 25 calls at .55 & it still remains in open interest and is still roughly even.

My Take: Certainly the move has not been missed here yet if there is another leg up a break above this flag does have about a $1 measured move to test highs. On my radar watching for a break above this flag.

NIHD shares looking weak here trader enters 9,000 Dec4/9 bear risk reversals for .05 debit.

I have seen this name played a lot and with a pretty succesfull track record but it is a small name and a longer term play so not really for me. One may want to have an alert set for a shorter term trade as this looks set to snap.

KSS starting to look interesting here with a solid day of work today grinding through 3 major supplies traders were active and bullish today rolling out 8,500 Oct 55 calls to 9,000 Nov 35 calls & rolling out 3,100 Oct 52.50 calls to Nov 52.50 calls.

My Take: Alert set for 53.10 break will be eyeing the November 55 calls Earnings are 11/14 and not a name I would be looking to hold through but this one is shaping up well here.

MRK banging ont he 10 day but thus far being rejected traders get bullish today with 2,000 Nov 49 calls, 5,000 Nov 50 calls, 1,500 Nov 48 calls, and 1,000 Nov 49 calls, also 2,000 Nov 47/49 call spreads.

Bullish positioning in a name working through supply another one I am very interested in earnings are 10/21 SO November gets it. Not a great earnings reactor though, but if you pull up a chart with earnings dates highlighted you see a tendancy in shares to run up into the event. Looking to see some committment to the name and a break and hold above 10 day with an eye on Nov. 48 or 49 calls. If I did enter just on the 10 day break and hold would be 48's if i wait for 48.71 then would be 49's.

GRPN been on a very nice run and trader see more upside and buys 6,000 Dec 12/15 call spreads for .98, also smaller size buyers in this weeks 12 calls & a 12/12.50 weekly call spread.

MY Take: Not a long-term player here personally will keep an eye on the 52 week high break, seems to be getting a lot of WS love.

CAG trying to bottom here and putting in a bit of a hammer here today traders very active and bullish today Dec 32 calls 3,500, Nov 31 calls 700, Oct 31 calls 1,000 running 12X daily avg call volume almost all of it offer side action. Net Delta +300K.. Also, 9/20 trader buy 2,000 Dec 30 calls.

My Take: Been a hot group so they could certainly come after laggards here shortly watch for confirmation of this hammer in the days to come and looks for it to retake the 10 day.

DAL early stage breakout here was on our list this week and a trader puts on an interesting spread selling 20,000 Oct 25 calls & buying 20,000 Jan 25 calls for a 1.16 debit. Also action in Dec 25 calls 2,900 Jan 25 calls 2,000, & over 3,000 Jan 19 calls.

Bullish high delta action here as traders see shares moving sharply higher into year end.

My Take: This large calendar spread is very interesting and seems cheap. Earnings are 10/23 another write opportunity and there will be a lot of selling front month premium opportunities as long as shares do not go into free fall.

I am stalking this one here, it is a very interesting play, one which even if shares did nothing one could profit from premium selling.

VALE: Dec 16/18 call spread 4,500.

BTU: 3,500 Oct 20 calls bought 19.25 still a long time from here but I have an alert set.

MYGN- Held lows long term bull enters 3,000 Nov 28/20 bull risk reversals for .90.

DNR- 2,500 Nov 19 calls. Been three big days going to keep my eye on it but do not want to chase it here would like to see some side ways action.

KMP- 1,500 Oct 77.50 puts bought.

VNDA- Interestin combo spread Dec 13/9 put spreads bought 2,000 & short Dec 18 calls. Not my thing but interesting.

ITMN- 2,000 April 15 calls bought. Shares are tight here and could bust out of this range soon.

NRGY- Buyers of 1,000 April 15 calls.

TRP- Massive action Over 9,000 Nov 45 calls bought running 60X daily call volume.. In addition yesterday saw buyers of 3,000 Nov 45 calls as well. Interesting action shares are very messy here need at least a 44.64 break and hold.

GCI- Combo trader sells to close 1k jan 26 puts & buys 1k Jan 21 puts & jan 32 calls. Alot of these strangles trade today about 4,000. Alert set for 26.90 Break after a big candle a day of rest so this could trigger tomorrow. Scalp only for me.

YOKU- Jan 30/35 call spread trades 3,000 times, also few days back the Dec 30/35 call spread traded 1,300 times. 29.30 break sets up well... set an alert.

Friday 9/27

MU seems to everyday break to new 52 week highs, and is just in one of those grooves where it is a name to watch everyday for a trade, it has become a great trading vehicle and bulls continue to be active in longer dated calls.

The Trades: Buyers: 8,500 Oct 18 calls .96, 3,500 Jan 18 calls 1.90, 2,500 Oct 20 calls .37, 3,000 Jan 21 calls .86.

Sellers: 4,000 Jan 18 calls, 7,000 Jan 16 calls.

My Take: The action has been bullish for months open interest in calls is over 1.8MM now, Jeffries slapped a $25 target on shares, but for me it is just a great trading stock and not something I am interested in for longer-term trades.

JCP selling 84MM shares caused a massive sell off and a view of the monthly chart shows shares down 27% in that time span and looks like the next stop could be low $7's.

The Trades: Trader rolls down 12,000 Feb 12 puts to buy 12,000 Feb 9 puts. Oct 12 puts rolled down to Oct 10 puts 17,000. A bullish trader buys 16,500 Jan 2015 10/15 call spreads at 1.37.

My Take: Well I have highlighted the bearish action many times in the past weeks and had the alert set for the 12.12 breakdown, if one did not trade it then I really see no reason to be chasing it down here down 27% in the past 4 weeks.

KO shares continue to tread water with the market, and just cannot seem to stage any rallies but traders continue to place bullish bets on the name.

The Trades: Trader buys 1,900 Oct 25th 38.50 calls & another rolls out of 8,400 Oct 40 calls to 8,400 Nov 40 calls.

My Take: Shares need to reclaim the 39 level before I would even consider it at this stage earnings are on 10/15 so noting the action for a possible play there. Also of note on 9/11 trader bought 13,000 Nov 40 calls. I have an alert set for 39 & also have the action noted for any potential earnings plays.

INTC shares rolling over and holding above the 50 day, but for how long is now the question. Bears smell blood and got extremely active today.

The Trades: 30,000+ Dec 22 puts

My Take: Hard to disagree with a bearish stance here and with $2MM in put premium bought today and 2x avg put volume with Net Delta -836K it is significant positioning. 50 day break sets up for a short and earnings are 10/15, and these Dec 22 puts at .62 may not be a bad play. Noted the action with a 50 day alert break down and for potential earnings plays.

COP shares in a nice orderly pull back here with a couple tests of the 10 day which has had a chance to catch up to price.

The Trades: 2,600 Jan 2014 65 puts bought for 1.14 & 300 Oct 70 puts bought at the end of the day for 1.24. Also some smaller size buys in Oct 67.50 puts.

My Take: I see no reason to be wanting to have short exposure to the name at the moment, earnings are 10/21, which is after Oct. expiration and not a name I am interested in an Earnings play so just information to me.

MGM and the gaming names in general have just been on magnificent runs this year as shares make new 52 week highs this week as did many of the names, but came back in Friday but bounced off the 10 day and rallied to close near the highs.

The Trades: Over 3,000 Oct 4th 20.50 calls bought from .11-.24 (Nice trade already for the early dip buyers)

My Take: As I said earlier seek out strength and I have been active in these names, and I have an alert set for the 20.40 break and will be piggy backing the same trade.

ESRX came under some heavy selling pressure of late but shares have stabilized and have held a key level right above the 200 day.

The Trades: Over 2,500 Oct 65 calls.

My Take: On 9/18 Trader bought 1,000 Nov. 72.50 calls at .11. These are low delta shots and just not my thing and I do not really see an edge here as shares need more time to stabilize.

MSFT shares have been volatile on a few news events earnings & CEO change. But are showing signs of life here late in the week and could set-up for a trade.

The Trades: Trader buys 10,000 Jan 34 calls, 2,700 Oct 34 calls, 3,000 Oct 33 calls rolled up to Oct 35 calls, also some smaller size buyers in Oct 34 calls.

My Take: I have seen worse set-ups for sure, and showed good strength on Friday in a weak tape so I have an alert set for 33.75-34 area and may look to either play weekly 34 calls or those Oct 34 calls.

EXXI we noted the bullish action earlier in the week and shares continue to grind higher.

The Trades: March 2014 29/36 call spread 1,000, Oct 31 calls 1,000 & seller of March 22 puts (1,000 in open interest already so could be closing action, confirm it on Monday).

My Take: Shares certainly look decent here and trader bought 4,200 Dec. 30/34 call spreads earlier in the week, won't be on my A list but I will set an alert and keep an eye on it.

CSIQ shares up 12.5% on the week as solars caught bids, and this one was able to go out on highs.

The Trades: 1,500 Oct 16 calls, 1,000+ Oct 15 calls ran 5X daily call avg with mostly offer side action.

My Take: 10% short and the weekly below shows about another $1 through last weeks highs if your a momentum player it could be in play, chasing solars is a dangerous game but I may take a look for an intra day scalp.

TSLA well really no introduction needed.

The Trades: Oct 4th 225 calls 600, Oct 4th 210/225 call spread 200, Oct 19th 195/200 call spreads 300 & Oct 4th 195/205 call spreads 300.

My Take: Always on watch everyday basically opening range highs, through Friday's highs, and/or intra day range breaks. $200 definitely achievable next week.

ELN- Traders active for over 14,000 Nov 16 calls from .20 chased all the way up to .35. Personally I would not chase this VOL pop with your money.

CSCO- Buys- 5,000 Oct 24 calls, Oct 26/21 strangle 3,700, 8,000+ Dec 20 calls. Some bullish positioning but really nothing to see here 22.90 alert set for a short into that May gap.

BBD- Trader buyers 1,000 Oct. 14 straddles for .80, alert set for 14.45 break out of this flag.

FB- Trader rolls 2,700 Oct 47 calls to Oct 50 calls, Trader buys 2,500 Nov 52.50/45 put spreads Nov 45 calls with over 3K & the most interesting and unrealistic the 1,000 March 2014 95 calls bought for .52 debit. Like MU just been a really great trading vehicle and will continue to be earnings 10/21 could shift it.

DAL- Follow on action to the interesting spread from Thursday trader buys 5,000 Jan 2014 27/30 call spreads and another trader rolls 2,000 Jan 22 calls to 2,000 Jan 24 calls. (Still stalking the other bull calendar spreads).

CTCT- Trader sells 4,500 Nov 25 calls to open.

GERN- Trader buys 3,000 Nov 3/5 call spreads. Also smaller size buyers in Nov 3 calls running 20x daily avg call volume.

ACXM- Long-Term bull buys 2,400 May 2014 30 calls as shares make new 52 week highs.

KSS- Trader buys 1,600 Nov 50 puts.

NE- Traders active in Oct. 41 calls over 1,000 & Dec 42 calls about 300.

XOM- Shares continue to trade poorly but some bullish action with 1,500+ Jan 2014 95 calls & 500+ Nov. 92.50 calls.

DOW- Some ugly candles and traders flew out of Oct 36 calls and booked their profits. Caution if long here.

JKS- Trader sells to open 1,200 March 2014 37 calls for .95 credit.

MTW- Jan 2015 25 & 30 calls finding buyers 5x daily avg volume, interesting longer term bulls.

XLU- 2,000+ Oct 25th 36 puts bought.

No comments:

Post a Comment