X looks like a great short here clinging onto the 200 day and I expect a flush coming soon. I was long puts earlier in the week and i booked nice gains and today reentered into the feb 22 puts where 10K traded so yes I like this idea and i am invovled. It is always a dangerous news as it can move big on news from BRIC countries.

IBM really fading here since the earnings gap and it is fading down so I like this idea for the gap fill and with market being a bit shaky its a good one to pick up. I got long the put spread today and I think I got in around .75ish so it offers great risk reward and it is a conservative short on a not too volatile name. Good solid set up in my opinion.

CREE if you prefer more volatile names and looking for a short this could be a place to try and top tick a name the June 44-41 put spread traded for around 1.40ish. Only really giving 2-1 and going out to June I have zero interest in this trade.

BRCM shares rolled over today and closed on the dead lows so another short idea as shares do look to be headed lower. I would probably only scalp the name though.

NWSA a name I can swear I have looked at everyday for at least a month and have not gotten invovled despite its great run. A lot of bullish positioning has been taken in the name especially farther out months. Could be playable through 28.22 or off 10-20 days.

IMAX shares look pretty decent here and today saw a big bullish position with 8000 june 27 calls bought. Again too far out for me but looks like a decent play.

HAIN tried to break out and failed and saw some big buys in Feb 50 puts today 16K 55 puts looks liek traders rolled up from the 50 strike. I did jump in a few of these I only got half fill at 2.30 and wasnt going to chase it as I had already added two other shorts and have TGT short as well.

Only had a few minutes to spare here so this is just a quick blog... Friday is tomorrow and i have a lot of action.

PCLN 695-685-675 put fly sets up nice today with the downgrade.

AAPL 455-460 call spread. Apple should be in that range tomorrow it could be 455 or 460 or something else obviously but hopefully it is 460 well see.

GOOG 760-770 call spread going to need a big move to hit big here, but if you have been following my twitter you know I have already booked big gains here this week.

GS 145-150-155 call spread sets up great here and same deal like GOOG got great gains out of the trade already.

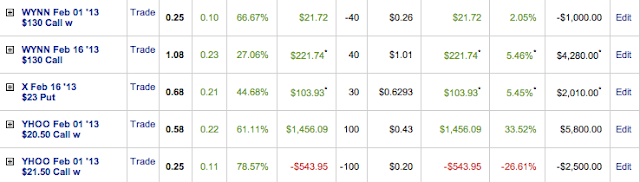

WYNN play could be decent front week will expire worthless for a nice gain and have to see how my feb 130 calls price. Report not that great but stevey is always entertaining.

TLM looks great nice move today so some solid gains there letting it run.

TGT has nice gains will decide what to do next week.

Today I was in scalp mode, I know some readers traded some with me, which is great and glad we made some money.

Scalped AAPL calls for +.50

NFLX +1 +.40 +.50 +.40 as we pieced out of it

SNDK +.02 +.18 +.21 +.10

So some solid gains scalping.

Some days just feel like scalping...

FB not looking so hot but well see if it can run back up and get us some profits.

HD down small, but important to know a lot of these plays are not going to give instant gains and some take time to play out as a lot of them are following flow so the reason behind could take time to develop. So if you cannot stand losing 10-20-30-40-50% on a trade options might not be for you.

IBM we discussed

TGT up 40% right now well see what to do.

X down a bit right now.

MRK not a great day now flat on the trade and earnings are tomorrow morning, which I forgot about so well see how it plays out.

TLM up about 35%

Giving out a bunch of ideas on twitter and posting real time emtires and exits on trades @keeblerelf3

Good Luck

Thursday, January 31, 2013

Tuesday, January 29, 2013

Wrap Up 1/29

A nice grind higher today with healthy action and I am again showing the 5 min chart showing the smallest of dips being bought aggressively just look at the up volume on any dips. Consumer confidence crumbled but nobody cares you get the quick algo sell off on the initial news and then people get short and its ripped right back in their face. A bit of a sell program came in at the end of the day but that was even bought right up in after hours action, which now trades above session highs. Tough to load up long and impossible to be short here tough market. AMZN missed on most metrics but after its usual 20 point dumping in after hours it is now up in after hours trade.

NOW recent IPO I think shares have been getting battered but bounced off lows as of late. Traders stepped in calling this a dead cat bounce of sorts and bought 2000 Feb 30 puts & 1K 25 puts.... Looks to be positioning for earnings. Looks liek may have gotten beating up today on the VMW guidance something worth noting into earnings.

WAG broke out this week and the end of last week but has put in a couple of topping candles here and traders were active in puts today across many strikes most notably are: 7K Mar 35's 2K 38's July 42 and 41 in the money 1K and 1500 respectively. The March 35's does have considerable OI and these could have been closing, but IV & price were increasing so could be buyingmore... will check OI tomorrow.

HPQ well in my opinion ultimately goes to zero, but for now shares broke down hard today but held the 20 day today bears were active. 32K Feb 16 puts 11K 15 puts and some other scattered plays throughout other months. I am interested in getting involved here on a break of the 20 day. Gap down tomorrow probably takes it out of play for me. Another option is gap up to the 10 day another possible entry.

SWKS keeps popping up on my options flow scans and I have yet to get involved as its been a tough one to get any sort of momentum. Traders were buying the Feb 22 & 23 calls and OI in those strikes is certainly swelling here also saw March 22 & 23 calls trading 1500 each. Just checked earnings are tomorrow so its something to look at and maybe take a small stab at.

FXI I really like this one and today traders stepped in a big way with 94K Feb 43 calls. Cheapies and expecting a big move. Big money has been correct on this ETF in the past so this one I am very interested in as well. I will look to enter it tomorrow, but will look at 42 strikes where 6500 were bought today as well.

VOD ive been in this name for a bit and have paired my position down making 200% gains on it but calls were active again today in July 16K 29 strikes and 2K 28 calls. So traders looking to stick with it definitely could be something developing with VZ here. I am intereted in getting involved in these longer dated options too. May do something here close out remainder of feb position and get long these or try to be perfect and close out my position and look for a pull back to enter.

BAX is certainly interesting here with a nice little pull back and today saw traders acrtive with 15K May 72.50 calls bought and 15K april 62.50 puts sold. This is a really large position and something I am interested in following. So many nice set ups but how many longs can one hold up here. May play in this sand box though on a break of the 20 day.

FDO looks awful here and saw some 3700 April deep in the money 62.50 puts trade today. Have to check OI tomorrow but definitely looks like a name to be shorted on any spikes or if market starts to pull back.

Just a note MRK saw a lot of call buying today 13K 43 calls and 3500 44 calls. Already invovled here and posted thoughts the other day so not going to put up chart, but I like it and calls are up nice right now and i left full position on.

Anyways, I am done posting the screen shots of my positions and will just type them it is too annoying to keep taking screen shots and going to find the picture to add here. It really adds no value to the discussion either I just did it initially to show that this is not paper trading or twitter b/s where I am long 500 GOOG calls and the trade goes to 0 and I just post 600 times about a winner and leave the other position unspoken about. This is my account of my trading and how I view the markets technically and through options flow. I win and lose and I am not ashamed of losers.

Anyways I booked about half the GOOG position some +.50 and some +1.00 holding the rest.

Booked some GS 1/5 +.80 and put the rest into a call fly. See twitter post.

Booked more VOD +1.00 still holding less than half position.

YHOO looks like 100% loser but with commissions I am better off holding onto it as you never know what could happen, but for now I will call it a loser -.23

AAPL I sold the 465-470 call spread against my position... seee twitter.

AMZN got long 280-290-300 call fly around 1.00... see twitter

BIDU ripped then tanked I sold 120 calls against mine to create a spread now hold the spread for .20 and am roughly even overall on the trade.

LONG DISH feb 38 calls at 1.10

MRK held whole position up like 70%

OLN sold out overall a small loser on the overall trade cause we booked gains yesterday.

NVDA holding down big today off like 40% on position.

TGT holding the puts down 10% right now

WYNN got screwed not too sure if it was my fault or if unlucky and they announced earnings date last night, but front week calls IV spiked so I am down on the position now and will probably hold through earnings as risk reward is there now.

X puts i am holding up about 12%

FB calendar spread holding pat.

Geez got a bit of a book going here, but been booking and leavign some runners!!!

Good Luck!

Monday, January 28, 2013

Market Wrap & Some Ideas For Tomorrow

SPY chopped and churned today and I post this 30 min chart just to show that all dips are quickly being bought, market looked set to close higher today but last half hour or so algos really started going wild and market got fairly volatile and we closed close to unch down fractionally.

ARUN broke out nicely today, but traders are already active in picking a top in the name as March 21 puts traded 6000 times. Worth noting and watching if shares start acting heavy or into earnings.

SODA got pounded today and I really have never heard or seen of anyone owning one of these machines. Traders were active today in far out of the money puts with 3000 March 42.50 puts at $1... geez 15% out of the money and still a dollar. Worth noting possibly for an equity short, but I am not interested in paying that premium for a short 15% out of the money.

EWZ saw a lot of put selling today, meaning people are short puts... bullish bets. Overall a positive sign. I am not in the game of selling premium yet but just of note as a positive tone to the markets. Brazil is probably one of the cheaper latin america plays currently, but seems to be some concerns over growth slowing etc...

TTWO is interesting here a name I have looked at in the past but never played but today traders were stepping in fairly large buying 9000 March 14 calls. Earnings are 2-5 I am interested in this play will look tomorrow for more follow through trading in the options market and look for an entry.

TWX has been on a strong run here RSI rolled over recently after putting in what appears to be at least a short term top. Today saw some odd positions taken with 8000 July 55 calls bought. Not really known as a big mover here but that is a fairly large position kind of far out for me but if there is additional accumulation could be something I get interested in.

HRB shares have been on a solid run and today a massive 25-20 bull risk reversal traded over 20,000 times. That is a serious position and one worth taking note of. I am not a fan of the company and while it shouldn't matter in trading its just not something I am interested in taking part of.

BBBY in a dead downtrend but shares looking to recover after putting in what appears to be a bottom. Today saw over 10,000 march 62.50 calls bought & what looks like a Jan 2014 57.50/77.50 call spread bought 3500 times. I am interested in the shorter term play here would like to see a break of the 60ish level for a run up to say hello to the 200 day.

Today's Action...

I posted a bunch of stuff at lunch time, but didnt include the things needed to get on stocktwits $$ or whatever still new at this stuff. Also will try to post more on Twitter when I enter positions.

BIDU will look to create a new play on this tomorrow. Like I showed in the lunch time post never chase these things in the morning when it ripped out of the gate these calls were trading at $1. I see people on Twitter chasing these all the time let it settle down pull back in and then look for an entrance. Look we saved ourselves 40% by staying patient and if it keeps running oh well we missed it. Better than getting caught up in opening bell euphoria when you see stock ripping a lot of calls hitting the tape. Only to see it retrace and your calls be worth .60 so not using a stop?

AAPL ripped today and I entered in today I failed to sell something against this position, but will look for some follow through tomorrow to make something happen.

MRK i bought the dip but it kept dipping will exit this position if 42.60ish fails.

NVDA I highlighted over the weekend and not going to discuss it much more. There was additional bullish flow today and a lot of these semis are looking good like ONNN MCHP etc.. There was 4500 weekly 12.50 puts bought today as well though a bit concerning.

OLN I saw some bullish positioning into earnings today and i decided to enter... The stock went crazy late day on a .50 run and I sold half my position booking about $700 in profits dont see if they reported yet, but overall in a good spot here. 345 consecutive quarters of payign a dividend... impressive! Is that even possible? Well thats what I see.

GOOG same thing as BIDU dont chase these things I saw people buying 765 calls at like 2.6 in the morning euphoria, we waited and were patient found a floor in GOOG or what appeared to be one and entered into $5 lower strikes for .55 less... Will do something with this position tomorrow as it is fairly large.

WYNN is consolidating nicely and saw some action in the 130 and 135 monthly calls so I like the play and decided to generate some front month premium. If all goes well and WYNN closes out the week 128-130 area I will then look to sell the monthly 135 calls and have a low cost basis if not free trade. Will keep you updated. Still a play that can be made.

As one of my readers pointed out to me TGT has been seeing a lot of bearish flow and it happened again today too, so much like X I could use a bit of short exposure here and on a weaker name so it makes sense. I may not hold into same store sales well see how the position performs. Also WMT has seen some bearish positioning.

X small speculative earnings play had some bearish flow and company is bleeding money each quarter so I am looking for a disaster. Getting a bit long too and could use some short side exposure.

YHOO one of the few positions I was able to remember to tweet. I wound up legging into the spread for .23 it never gave me that run into earnings I was looking for but still 5ish to one here risking 2300 to make 10K and I see it bid to 21.30 right now... So maybe I finally hit an earnings play would be nice.

There was some other interesting stuff, but this track pad/mouse is bothering me right now... Will note some of the stuff for tomorrows post. TQQQ saw some bullish positioning expecting tech to move higher near term something worth noting.

Last, I been seeing some questions on certain position but the one that stood out to me the person already covered their short so I wont discuss it, but I am willing to look at 1 or 2 positions a week and give some thoughts on how you could make it more effective with options. If interested post a comment or something and I will pick a few and highlight them.

May do some earnings strategies later.

Take Care

Half Time Report

SPY is lower thus far after a small pop at the open was faded and then it went dip-buy-flag-higher-flag-higher-dip-higher- and now falling after failing at the highs of the day. We will see if dip buyers appear again and send this to the highs or if we break down past all of the higher lows put in previously.

BIDU we got invovled in today as it ripped at the open with massive call buying in this weeks 115 calls. Now important to note as all these calls are being bought the stock is ripping now you can chase here or wait for a retrace. I will always wait for the retrace and if it keeps going then it goes without me.

So now we have options we can write a 120 call against ours and cut our cost basis in half or we can create a call fly selling 100 120 calls and buying 50 125 calls and put our cost basis down to .10. Which would give us 50-1 risk reward ratio. For now we are standing pat.

GS failing at this 145 level where big calls were bought early in the morning but we waited for it to retrace create a bottom and then get invovled.

So our options right now are to stand pat and see if we can take out that 145 level later in the day currently 150's are trading for about .20 so we could lower our cost basis by about 40% but for now we will look for a better spot.

AAPL dropped out of the gate and then exploded so we took the small retrace to get invovled.

So we have a lot of options here including selling the 460-465 call spread to create a fly and guarantee ourselves a .20 gain or go further out and keep some risk but have higher probability of picking a range. Will wait for tomorrow and see where OI sits in many numbers.

YHOO saw early call buying this morning into earnings and we entered. Here we are benefiting from a lot more call buying following us and IV is spiking.

Right now can sell two times as many 21.50 creating a ratio call spread and have a free trade into earnings, but with IV spiking I am going to wait until the end of the day adn see if we can run into the close and create a play then.

NVDA from yesterdays blog seeing follow through call action and stock it up.

PCLN giving back a lot of fridays candle needs to show some strength here today losing half that candle or more would not be a good sign, especially with Nasdaq up and overall market down small.

Sold rest of XLV & 1/4 VOD will update those later in post.

Good Luck!

BIDU we got invovled in today as it ripped at the open with massive call buying in this weeks 115 calls. Now important to note as all these calls are being bought the stock is ripping now you can chase here or wait for a retrace. I will always wait for the retrace and if it keeps going then it goes without me.

So now we have options we can write a 120 call against ours and cut our cost basis in half or we can create a call fly selling 100 120 calls and buying 50 125 calls and put our cost basis down to .10. Which would give us 50-1 risk reward ratio. For now we are standing pat.

GS failing at this 145 level where big calls were bought early in the morning but we waited for it to retrace create a bottom and then get invovled.

So our options right now are to stand pat and see if we can take out that 145 level later in the day currently 150's are trading for about .20 so we could lower our cost basis by about 40% but for now we will look for a better spot.

AAPL dropped out of the gate and then exploded so we took the small retrace to get invovled.

So we have a lot of options here including selling the 460-465 call spread to create a fly and guarantee ourselves a .20 gain or go further out and keep some risk but have higher probability of picking a range. Will wait for tomorrow and see where OI sits in many numbers.

YHOO saw early call buying this morning into earnings and we entered. Here we are benefiting from a lot more call buying following us and IV is spiking.

Right now can sell two times as many 21.50 creating a ratio call spread and have a free trade into earnings, but with IV spiking I am going to wait until the end of the day adn see if we can run into the close and create a play then.

NVDA from yesterdays blog seeing follow through call action and stock it up.

PCLN giving back a lot of fridays candle needs to show some strength here today losing half that candle or more would not be a good sign, especially with Nasdaq up and overall market down small.

Sold rest of XLV & 1/4 VOD will update those later in post.

Good Luck!

Sunday, January 27, 2013

Some possible things to watch tomorrow.

I decided to skip the part 2 of perusing the markets as after I read through part 1 I found it to be, well, pretty dull and really not that useful, but here are some ideas for the week ahead.

COP shares broke out last week and rallied very strong and traders stepped in on friday to the tune of over 30K March 62.50 calls. Certainly seems like a value here trading at 7 and a half time earnings and yielding 4.5% and there were some massive positions taken in those march calls. Would like to see a pull back to the 10 day to look to get involved in a similar march strategy.

NVDA is a semi that really has not rallied and has been stuck bouncing around a range, but traders got active looking to capture a move after putting in a strong day on Friday and earnings looming. 6K Sept 13 calls, March 13 & 14 calls seeing around 4K each. Earnings are in mid february and NVDA would be more of a speculative play here, but is one I am a bit interested in to see a run into earnings and then decide before hand what to do with the position. With earnings looming IV should increase giving another advantage to the trade here. One I will consider tomorrow.

CBG with a nice clean break out on thursday and friday and I like the fact that it retraced a bit on Friday as it makes an easier entry through the highs on that wick or could be interested off the 10 day or an entry around the fork where it has been trading up against for some time. 5K March 22 calls were bought on friday and is what initially caught my attention. This one is interesting and could be one to watch.

SNPS is definitely interesting here, and could be one to get involved in through Fridays highs or on any pull back. Friday saw some massive positions taken 6K March 35 calls & June 35 with 1400 in comparison to the amount of options this stock normally trades this is certainly a large position and one to keep notice of.

NKTR is setting up here after bottoming out late last year and after a nice pull back made a nice move on Friday. Traders were active in 5K fEB 10 calls & may 10 calls and OI is growing in May and Aug. The Feb 10 calls could be worth a play its rather speculative but this one could put in a run like it did last sept and be good for a nice little score.

MRK a strong day on friday and is looking to break out this is a sector I have been bullish on for some weeks with my XLV play still rolling half the position. Traders stepped in and bought 10K Feb 43 calls (need to check OI tomorrow. and some activity in the Feb calls. I have had a lot of success following flow in this name and may look to close out my XLV position tomorrow and roll into these Feb calls.

YHOO reports after the close on Monday and is setting up here for a move higher and after last week it seems like they're taking up most stocks after earnings reports. A possible play is a 1 by 2 ratio call spread here buying the weekly 21 calls and selling 2 times as many 22 calls for .02. 50 to 1 play has great risk reward and can be played very cheaply.

COP shares broke out last week and rallied very strong and traders stepped in on friday to the tune of over 30K March 62.50 calls. Certainly seems like a value here trading at 7 and a half time earnings and yielding 4.5% and there were some massive positions taken in those march calls. Would like to see a pull back to the 10 day to look to get involved in a similar march strategy.

NVDA is a semi that really has not rallied and has been stuck bouncing around a range, but traders got active looking to capture a move after putting in a strong day on Friday and earnings looming. 6K Sept 13 calls, March 13 & 14 calls seeing around 4K each. Earnings are in mid february and NVDA would be more of a speculative play here, but is one I am a bit interested in to see a run into earnings and then decide before hand what to do with the position. With earnings looming IV should increase giving another advantage to the trade here. One I will consider tomorrow.

CBG with a nice clean break out on thursday and friday and I like the fact that it retraced a bit on Friday as it makes an easier entry through the highs on that wick or could be interested off the 10 day or an entry around the fork where it has been trading up against for some time. 5K March 22 calls were bought on friday and is what initially caught my attention. This one is interesting and could be one to watch.

SNPS is definitely interesting here, and could be one to get involved in through Fridays highs or on any pull back. Friday saw some massive positions taken 6K March 35 calls & June 35 with 1400 in comparison to the amount of options this stock normally trades this is certainly a large position and one to keep notice of.

NKTR is setting up here after bottoming out late last year and after a nice pull back made a nice move on Friday. Traders were active in 5K fEB 10 calls & may 10 calls and OI is growing in May and Aug. The Feb 10 calls could be worth a play its rather speculative but this one could put in a run like it did last sept and be good for a nice little score.

MRK a strong day on friday and is looking to break out this is a sector I have been bullish on for some weeks with my XLV play still rolling half the position. Traders stepped in and bought 10K Feb 43 calls (need to check OI tomorrow. and some activity in the Feb calls. I have had a lot of success following flow in this name and may look to close out my XLV position tomorrow and roll into these Feb calls.

YHOO reports after the close on Monday and is setting up here for a move higher and after last week it seems like they're taking up most stocks after earnings reports. A possible play is a 1 by 2 ratio call spread here buying the weekly 21 calls and selling 2 times as many 22 calls for .02. 50 to 1 play has great risk reward and can be played very cheaply.

Subscribe to:

Posts (Atom)